When it comes to saving money, most people know that they need to save more … but getting started can be the biggest challenge they will face. The reasons for not saving vary from person to person. For some, it’s rooted it their limiting money mindset of, “I’m not good with money” or “I don’t have enough to make a difference” (if that’s you, then you need to check out my blog post on the 9 most common limiting money beliefs – and how to transform each one). For others, saving money sounds boring.

No matter what your reason, the best way to save is to just start. That’s the beauty of money saving challenges – they give you motivation to start. Even better, they give you a challenge to help make it a bit more “fun”.

Here are 12 months of money saving challenges you can try for a year. But don’t think that you have to wait until January 1st to start this 12-month challenge. You can actually start it at any time – even if it’s not the start of a month. That’s because the first challenge can be started at any time.

Also, feel free to change the order of months #2-12. The order of the challenges isn’t important – the only thing that matters is sticking to the challenges and saving money. So, set yourself up for success. For example, for the “No Spend” challenge, don’t try this challenge in December when there’s Christmas parties and gifts to buy. Save this challenge for a month that you know will be quieter.

Finally, remember your motivation for doing these challenges. For each month, set a goal of what you will use the money for. It could be to pay off debt, start your emergency fund or save up for a vacation. Ready? Then, let’s start saving!

Month #1: The 30-Day Track Your Spending Challenge

So, this challenge isn’t about trying to save money or changing your spending habits – or, at least, not yet. It’s about understanding where your money is really going. Once you have tracked your spending for at least 30 days, go through and look for any insights. This will give you some inspiration where you can reduce your spending for the next 11 challenges.

There are various ways to track your spending – whether it’s in a spending journal, on paper, in excel/Google Sheets or even an app. Pick a method that you’re comfortable with and you find easy to stick with. It doesn’t have to be too complicated or detailed, as long as it will allow you to see some insights on where you are spending your money.

Month #2: The 30-Day Meal Planning Challenge

What does meal planning have to do with saving money? Simple – instead of eating out, simply plan your meals for the next 30 days. Why should you try this challenge? Well, eating out can cost anywhere from $10-$20 a meal – or more! So, if you buy lunch out every work day, you’re spending approximately $2,600 to $5,200 every year! That’s money that I bet you would love to put towards some of your personal financial goals.

Month #3: No Spend Challenge

During this challenge, you can’t spend money on any non-essential items. Wait! Don’t let the name fool you – you can spend money. For the duration of this challenge, you are allowed to spend money on necessities – and nothing else.

Before you start, get some clarity on what is essential vs non-essential. Not only will this help you to stick to the challenge, but you won’t have to figure out before each purchase if you can buy it … or not!

* What is considered essential? Things like rent, utilities, gas, groceries, bills, etc.

* So, what’s considered non-essential? Well, that’s things like eating out, entertainment, shopping, etc.

Month #4: Save a Dollar a Day Challenge

Have you heard of the 52-week savings challenge? It’s where you save one dollar more than you did the week before. Well, this challenge is similar, except that you save a dollar every day.

Here’s how it works:

Day 1: Put $1 into your savings jar

Day 2: Put $2 into your savings jar

Day 3: Put $3 into your savings jar

Day 4: Put $4 into your savings jar

I think you get the idea – just keep up this pattern. By day 30, you will put $30 into your savings jar. At the end 30 days, you’ll have saved a total of $465. Woo hoo!

Month #5: Challenge Your List of Bills and Subscriptions

Go through and list all your different bills and subscriptions. For this month, you will look at each one to determine where you can reduce fees or cancel subscriptions.

* Make note of any bills where you pay late fees or go over the allotted amount. If you are paying your bill late, set a reminder on the calendar or in your phone of when the bill is due. If you have services (ie: internet data) where you go over the allotted amount, you might want to look at going to a higher plan. Especially if the different between your current plan and the next higher plan is actually lower than the extra fees you are paying.

* Do you use all the subscriptions you have? Are there any that you could do without? However, if you use a subscription a lot and it brings you joy – that’s a keeper!

* Call your service providers (i.e.: cell phone company, cable company, etc.) and ask for a discount

Month #6: The No Spend Events Challenge

A “No Spend Events” challenge is similar to the “No Spend” challenge – except that it focuses on entertainment. For this month, you’re not allowed to spend any money on going out. The bonus of this challenge, is that you focus on experiences over material goods.

To set yourself up for success with this money saving challenge, the key is to look for free events you can go to. It’s important to live life – but you don’t have to spend a ton of money to enjoy life. Here are some ideas:

* Community events

* Nature walks

* Host a pot-luck dinner party at your house

Month #7: The Pantry Challenge

This month’s money saving challenge is called the “pantry challenge”. It’s where you focus on using up food that is in your pantry, so that you can reduce your grocery bill. Start by making an inventory list of all the food in your pantry. As you make your list, group together all the like items – spices in one drawer, pasta, canned food, etc. This will help you to see how much you have.

You are allowed to buy more food, especially perishables or anything absolutely necessary. However, you will save money by using up food you already have. Bonus: it’s a great way to clean out your cupboards!

Month #8: Save a Quarter or Two Challenge

All right? Are you ready to save more money? For this challenge, it is similar to the “save a dollar a day” challenge – but this time you are saving 50 cents every day. If you need to, feel free to reduce the amount to 25 cents.

Here’s how it works:

Day 1: Put $0.50 into your savings jar

Day 2: Put $1.00 into your savings jar

Day 3: Put $1.50 into your savings jar

Day 4: Put $2.00 into your savings jar

I think you get the idea – just keep up this pattern. By day 30, you will put $15 into your savings jar. At the end 30 days, you’ll have saved a total of $232.50.

Month #9: One Drawer Challenge

This month’s challenge is a little different. Every day, declutter either one drawer, one shelf or one closet in your house. Go through everything and put it into three piles: keep (these go back), sell/donate or trash. At the end of the month, try to sell everything that is in the sell/donate pile. Anything that you can’t sell, you have to donate. As you go through your stuff, group like items together. It’s easy to forget what you have when it’s all spread out around your house – resulting in you buying duplicates (or triplicates) of items.

Bonus: you may have forgotten about stuff that you bought – feel free to bring it out and start using it now!

Month #10: The Bad Spending Habits Jar Challenge

This month, you are going to come up with a list bad spending habits. Then, every time you commit a “bad spending” habit, you have to put $1 into a jar. The best part of this challenge – you’re motivating yourself to create better habits AND you’re saving money! How much money you save is up to you – in terms of being able to follow your own rules. The best part is if you don’t commit any “bad spending” habits this month, you’ll probably end up saving money anyways because you’re focused on where your money is going.

Here are some rules to put on your list:

* No impulse buying

* Avoid paying late fees – by paying bills on time

* No eating out (or put a limit on how many times you can eat out each week)

* When grocery shopping, only buy items on your grocery list

* Stop paying for subscriptions or memberships you never use

* Don’t buy cheap products that break easily

* Pay the full amount on your credit card, to avoid interest payments

Month #11: Save a Random Amount Challenge

For each day this month, choose an amount at random that you have to put in your savings jar. Here’s an opportunity to be creative and have a little fun – while saving money at the same time.

Here are a few examples of how to pick your amount each day:

* Roll a dice. The number you roll is the amount you have to save that day,

* Write a different amount on 30 tiny pieces of paper. Each day, pick one piece of paper – and you guessed it – that’s the amount you have to save for that day,

* Google “Random number generator”. You choose the minimum and maximum amounts – then click on the “generate” button to get your number for the day!

Month #12: The Holiday Gift Alternatives Challenge

When it comes to the holidays, the price of all those gifts really adds up. It’s easy to get caught up in the season – let’s face it, opening up gifts is fun! But do we really need so much? This challenge is all about saving money on gifts – but still creating that holiday spirit.

Here are some alternatives:

* Create your own “gift” certificate. The certificate entitles the receiver to get something from you or do something with you (i.e.: baking cookies together, mowing the lawn, etc)

* Secret Santa gift exchange. Instead of buying a small present for each person, randomly draw a name for just one person. You can get a bigger gift, but it will still be less expensive than something for each person.

* Experience gifts. These gifts are focused on experiences, instead of material items. The goal here is to create new memories, where being together is what counts the most! It could be going to the movies, a museum, a nature-walk, a day trip – anything that everyone will enjoy doing together.

* Family gift. For this gift alternative, everyone puts a little money towards buying something for the whole family. It could be family portraits, a new couch or supplies for a hobby you do together.

* White Elephant Exchange. For this gift exchange, you buy one funny gag gift. Wrap it up and each person chooses a present under the tree at random. To add to the fun, allow “stealing” – where you take someone else’s gift.

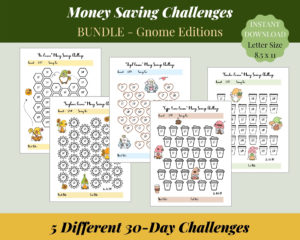

Yeah! You made it to the end of the 12 months of money saving challenges! No matter what, just know that saving money is always a good thing! Need some help sticking to your challenges? Then, ask a friend to join you and keep each other accountable for meeting your goals. Need some visual motivation? Then check out my money saving challenge printables on Etsy!

Until my next blog post, here’s wishing you lots of joy and happiness!

With love,