Have you heard about this fun challenge called a “money saving challenge”? A money saving challenge is where you make saving money into a game. You set up the “rules” of the game and then go about “playing”! Best of all, by the end of the challenge, you’ll have saved some money.

Okay, so maybe you have heard about it, but is it REALLY that fun? Yes! That’s because changing your mindset from “saving is boring” TO “saving is a fun challenge” really does make a difference. Don’t believe me – then I guess you just have to try it for yourself. Even better, invite a friend to do the challenge with you!

In a previous post, I showed you 12 different money saving challenges – one for each month. Well, I’m back with part 2! Here are 9 more fun and easy money saving challenges for you to try this year.

The 52-Week Savings Challenge

Here’s a popular savings challenge that I just love! After one year, you will be able to save $1,378. Every week, you save one more dollar than the week before.

Here’s how it works:

Week 1: Put $1 into your savings jar

Week 2: Put $2 into your savings jar

Week 3: Put $3 into your savings jar

Week 4: Put $4 into your savings jar

I think you get the idea – just keep up this pattern. By week 52, you will put $52 into your savings jar.

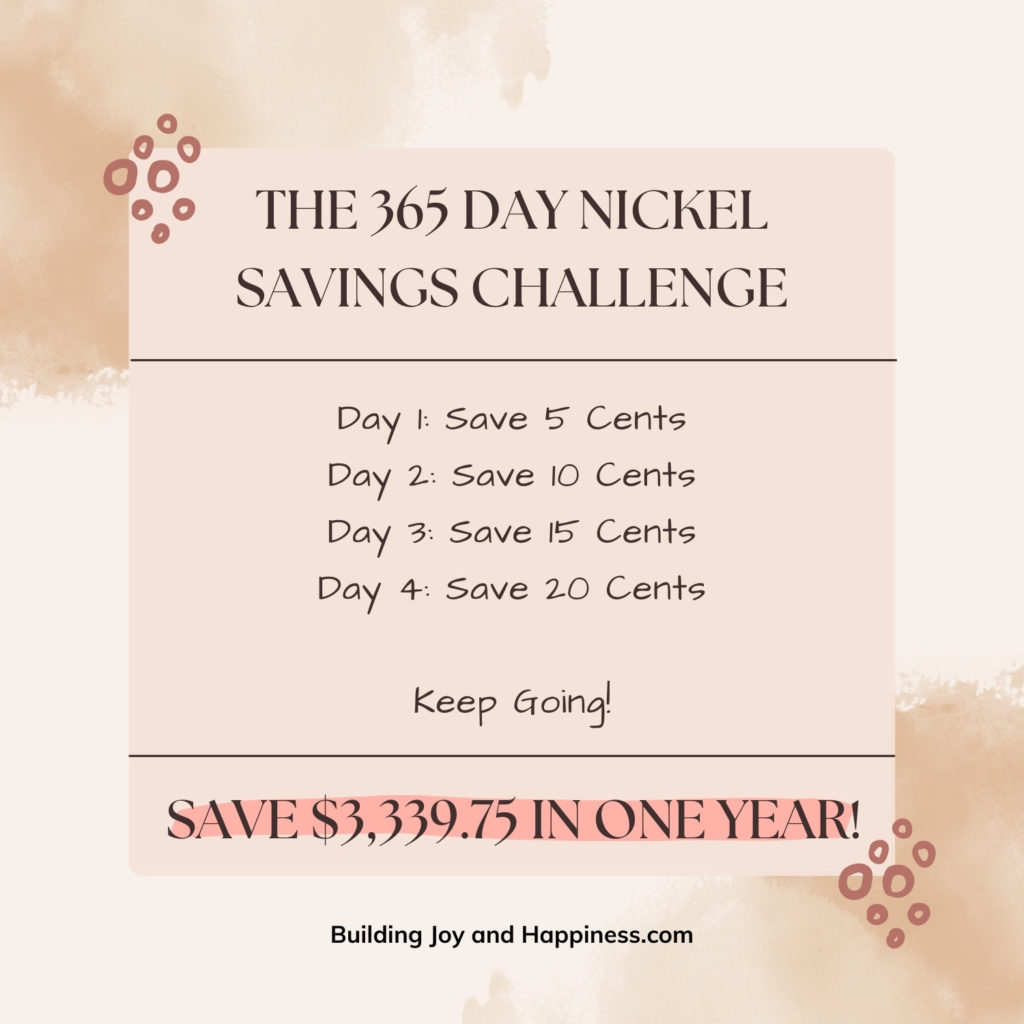

The 365 Day Nickel Saving Challenge

This challenge is similar to the 52-week savings challenge, but instead of putting money into your savings jar once a week, you are putting money in once a day. How much? You start with just 5 cents a day. Each day you add 5 cents more than what you did the previous day. By day 365, you are putting $18.25 in your jar for that day.

Here’s how it works:

Day 1: Put 5 cents into your savings jar

Day 2: Put 10 cents

Day 3: Put 15 cents

Day 4: Put 20 cents

Keep it up! By the end of the challenge, you’ll save $3,339.75! Wow, who knew that saving just 5 cents could add up to so much!

The 12 Week Money Saving Challenge

For this challenge, you put aside $84 every week. At the end of 12 weeks (or 3 months), you’ll have saved $1,008! The best part is that this challenge only lasts for 3 months, so it’s not a long-time commitment. But does saving $84 every week sound tough? If so, check out my post on Tips for Frugal Living to help you save more money!

Save a Dollar Challenge

This challenge works great when you pay with cash. In this challenge, every time you receive a one-dollar bill (or Loonie in Canada!) as change, just put the change into an envelope or your savings jar. If you want, you can modify this challenge. Instead of $1, make it a $5 dollar bill.

Do this for the whole year and then, at the end of the year, count all the money. Use it to pay for your Christmas gifts or fun experiences to do with your family over the holidays!

Save Your Spare Change Challenge

This challenge is similar to the “save a dollar” challenge – every time you have any loose change in your pocket or purse at the end of the day, simply add it to your savings jar or piggy bank. Find some coins on the ground? Add them to your piggy bank as well!

With this challenge, you keep saving your spare change for years. BUT – you set a “reward” timer. When the “reward” timer is done, you get to use the money to put towards a financial goal. For example, the reward timer lasts one month. At the end of every month, you use the spare change to buy yourself a treat.

No Eating Out Challenge

For this challenge, you first have to decide how long the challenge will last – one week, two weeks, one month. No matter how tired you are after work, no eating out. Did your friends just text to ask you to go out for dinner? No worries – just invite them over to your place for a dinner party!

Round-Up Your Money Challenge

Most banks offer a service where you can round up your purchases to the next nearest dollar and then have that change deposited into your savings account. This works great when you use debit to pay for a lot of your purchases.

The Paycheck Challenge

If you budget by each paycheck, this challenge is perfect for you. If not, it’s still a great idea! For this challenge, put $20 into your savings account every time you receive a paycheck. After a year (assuming you are paid every two weeks), you’ll have saved $520. Want to save a little more money? Simply increase the amount saved each paycheck.

One thing to point out – just make sure to put the money in a separate savings account (or in a savings jar) and not in your regular bank account. This challenge is perfect if you’re trying to build up your emergency fund, save for Christmas presents or even save up for a vacation.

Save Money at the Grocery Store Challenge

Groceries cost a lot of money and the price of food is only going up. But not all grocery stores are the same. Obviously, you pay more for food from a fancy grocery store. However, there are other ways you can save money when grocery shopping, such as:

- Try shopping at a low cost/discount grocery store,

- Buy in bulk,

- Look for sales and adjust your meal plan accordingly,

- Reconsider buying organic food,

- Avoid pre-packaged foods (you pay for the convenience).

When Should You Start One of These Money Saving Challenges?

Any time will work, but sometimes it’s easier if the starting point is associated with something else. Here are some suggestions:

A New Year

Starting a savings challenge on January 1st is perfect if you’re doing a challenge that will last for the whole year. Think of it as your next New Year’s Resolution. The trick to doing a savings challenge for the whole year is to keep the amount small, so that it’s easy to complete your challenge.

A New Month

Does the thought of sticking to a money saving challenge for a whole year sound scary? Does it sound like it’s too long? Then try sticking to a challenge for only a month. Start of the first day of the month. Even better – start a new challenge each month.

To help keep you motivated during your money saving challenges, think about what your financial goals are. Attach a specific goal to each challenge. If you want, it could be the same goal each month, or change it up. Either way, keep track of how much you saved each month and be proud of the progress you are making towards your goals!

A New Season

Start a 90-day challenge at the start of each season, with a goal that relates to that season. For example, start at the beginning of spring to save up for your summer vacation. Or, use the start of fall to save up for Christmas presents or fun family Christmas experiences.

No matter what challenge you try or when you start, just know that saving money is always a good thing! Need some help sticking to your challenges? Then, ask a friend to join you and keep each other accountable for meeting your goals.

Need some visual motivation? Then check out my money saving challenge printables on Etsy!

Until my next blog post, here’s wishing you lots of joy and happiness!

With love,